FAQs

Choose a category or scroll through the Frequently Asked Questions

Account Information | CPCUi & E-Statements | ATM/Visa Debit Cards | E-Transfer Services

Account Information

What is the routing number?

2724-8200-3

How can I join?

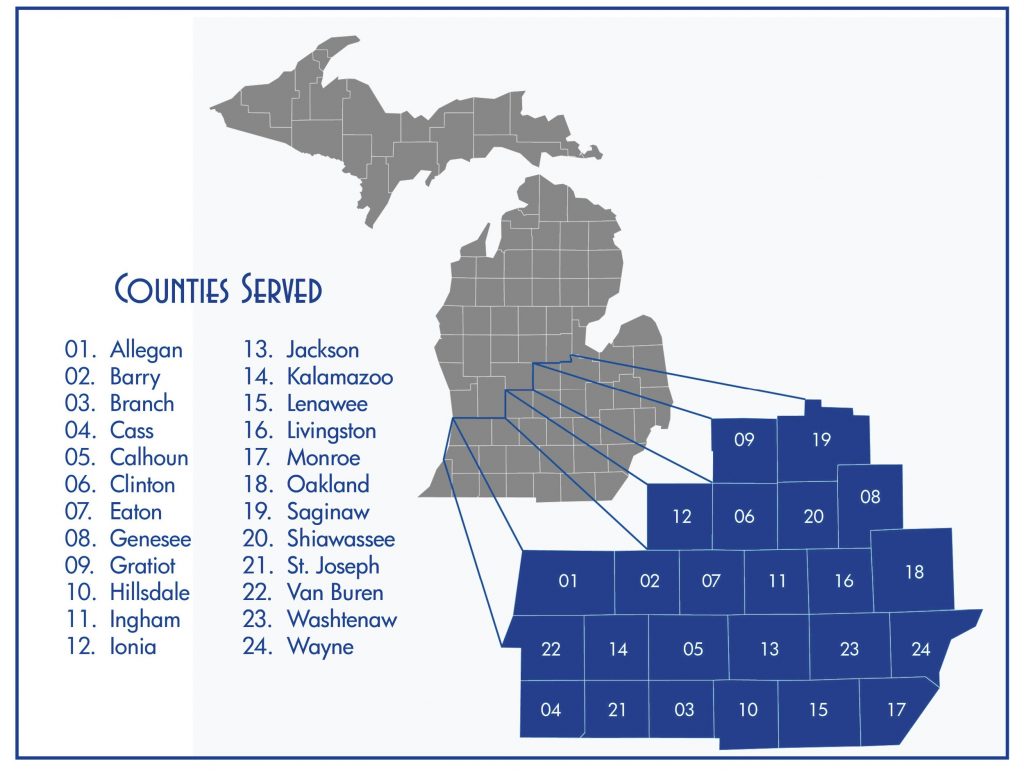

Membership to CPCU is offered to anyone who lives, works, or worships in our charter area (pictured above). If you are eligible, we’d love to have you as a new member! For security purposes and your safety, we do not open accounts online at this time. We do have two easy ways to join:

- Call us at 517-372-2400

- In person at any branch or school branch location

You will need a state issued ID or driver’s license and a social security number. All members deposit $25 in a share account, $5 for youth accounts, which serves as your par value and allows you one vote at the annual meeting.

How come I can’t contact the Audio Teller?

Our Private Line Audio Teller System is no longer available. For 24HR access to your account, please utilize our E-Services – 24/7 Online access to your account with CPCUi. To get started, complete and sign our E-Services Enrollment Form at any branch and read our step by step instructions for logging in for the first time. You can always call us to talk to a real person during normal business hours at any location to do anything you could previously do with the Private Line Audio Teller.

Why is there always $25 more in my savings account than is available?

Every adult member keeps $25 in a Prime Share Account (youth up to age 18 keep $5) as their share of ownership in the credit union. The par value may not be withdrawn.

What if I need to change my address?

Online: You can change your address directly through CPCUi. Log in to your CPCUi account, and click the User Profile tab > Change Address.

In person: You may complete THIS FORM and return it to any branch or by fax to 517-371-2728.

How do I change my name after a marriage or divorce?

If your name has legally changed due to marriage or divorce we do need a copy of the marriage license or divorce decree along with your driver’s license and your new signature on an account card for the permanent file.

How do I close my CPCU account?

We need to have written instructions to close the account with a signature from the Primary Account Holder. All loans and credit card balances must be paid in full.

CPCUi & E-Statements

How do I get started with online banking?

Simply read, sign and return to any branch a copy of the CPCUi End User Agreement. Once we have that we will issue you a password with instructions to get started.

I tried my password too many times and I’m locked out. How do I get unlocked?

Please contact the credit union during regular business hours and we will get you unlocked and issue a new password if it is needed.

Why do I have to change my password every 90 days?

Passwords must be changed every 90 days for your protection. They must contain 8 – 23 characters: at least one uppercase & one lowercase letter, at least one number and at least one special character.

What should I do if I forget my password?

During regular business hours, you may always call the credit union for a new password. There is also a “FORGOT PASSWORD” button under the log-in box. If you have a current email address on file, this feature will send a new password to that email address- it is good for 20 minutes. Make sure to change your password once you are logged in.

Why do I have to choose a picture and answer security questions?

Multi-factor authentication includes choosing a picture to identify our site and answering security questions. This is a government requirement to enhance online security. Once your device is “activated” it will be used in conjunction with your account ID/Password for authentication. You will no longer have to answer a security question on that device.

What if I forget the answers to my security questions?

Please call the credit union if you receive a lock-out message.

I am having trouble logging in to online banking, what should I do?

If you are having trouble logging in, please call the credit union. If it is after hours please leave a message and we will return your call the following business day.

Will I be able to view all of my accounts when I log in?

When you log into CPCUi, you will see your account information. Browser version: On the right side of the screen, there is a drop-down box, which includes all accounts on which you are joint. You may transfer between these accounts.

Mobile App version: On the bottom right, tap the “MENU” tab. On the top of your screen there will be your name and last 3 digits of your account #. You can tap the arrow on the right to view any accounts on which you are the owner or joint.

How will I view my e-statement?

Browser version: Click on the hamburger menu in the upper left of your screen and choose “Statements + Documents“. Under the Document Type drop down, choose “Account Statement” You may view them by date.

Mobile App version: On the bottom right, tap the “MENU” tab. Then tap on “Documents and Statements”. Scroll down until you see “MEMBER STATEMENTS” in blue and choose by month.

ATM/Debit Visa Debit Cards

My card is cracked and/or not working, how do I get another?

Call the credit union and we will order a replacement card for you.

What do I do if my card is lost or stolen?

Download our app and you can Remote Control Your Card(s) where ever you go! You can temporarily disable your card in case of misplacement, but If you’re sure you lost your card or that someone stole it, you can also cancel your card and order a new one right through our app. You can always call us during normal business hours and ask us to shut off your card or to order a new one.

For all other concerns about ATM/Debit Cards: Call anytime, 24/7, 1-800-264-5578.

Credit Cards: Call the credit union right away so that we can block your card and order a new one. During non-business hours call 1-800-828-3901.

Is there a limit to how much cash I can withdraw from an ATM?

Yes. For your protecion, the standard daily limit per business day is $750.00 for ATM cash withdrawals. The standard daily limit for point-of-sale (POS) purchases including POS cash back is $1000.00. CPCU may temporarily raise one or more of these limits at our discretion and per member request.

Student limits: $50 daily limit for ATM cash withdrawals, $500 for POS purchases.

Why isn’t the deposit I made into the ATM available right away?

Funds deposited into an ATM are not immediately available. ATM deposits must be collected, verified and entered into our system which will delay the time that they become available to you. Typically funds deposited into an ATM are available after 3 business days.

E-Transfer Services

I have a CPCU account, can I receive an E-Transfer?

Yes! There is no charge for an incoming electronic transfer. Please give these instructions to the institution sending the transfer to your CPCU account.

Receiving Institution: Consumers Professional Credit Union #272482003

Final Credit to: Your Name, Your Account Number

Can CPCU send money from my account to another institution or person?

Yes. We offer Same Day E-Transfers and Next Day E-Transfers. Please see our current Member Services Price List for complete details. If you use our bill pay service iPayPlus, you may also arrange to send money to another person or to pay a bill.

If you are using a screen reader or other auxiliary aid and are having difficulty with this site, please call 1-800-292-2728